Barclays CEO reacts to Epstein revelations amid Staley scandal fa

In the wake of the Epstein revelations and Staley fallout, Barclays has found itself at the center of a media storm. The recent release of court documents has intensified scrutiny on Jes Staley, the former Barclays CEO, and his ties to the late financier and convicted sex offender Jeffrey Epstein. As the situation unfolds, Barclays’ current leadership grapples with the repercussions of the scandal and its implications for the bank’s reputation.

Barclays Faces Intense Scrutiny

Barclays has been thrust into the spotlight following the Epstein revelations and Staley fallout, casting a shadow over the bank’s operations and leadership. As the financial giant navigates the aftermath of these disclosures, questions about the bank’s internal policies and the ethical standards of its executives have surfaced. The revelations have prompted a broader discussion within the financial sector about accountability and oversight.

The documents, which were unsealed as part of a legal battle involving Epstein’s estate, disclosed a series of communications between Staley and Epstein, raising concerns about the depth of their relationship. While Staley has consistently denied any knowledge of Epstein’s criminal activities, the communications have fueled speculation and led to increased scrutiny from regulatory bodies.

Barclays CEO Responds to Allegations

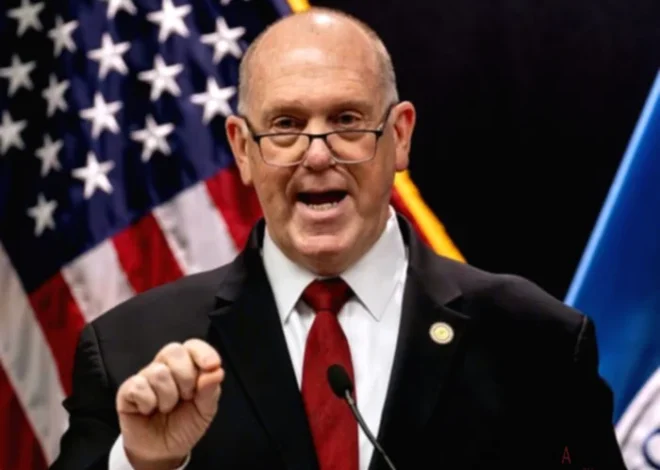

In response to the mounting pressure, Barclays’ current CEO, C.S. Venkatakrishnan, issued a statement addressing the situation. Taking over the reins after Staley’s departure, Venkatakrishnan emphasized the bank’s commitment to transparency and integrity. He reassured stakeholders that the bank is cooperating fully with regulatory inquiries and has implemented measures to prevent similar issues in the future.

Venkatakrishnan’s statement highlighted the bank’s efforts to strengthen its compliance framework and enhance its due diligence processes. He underscored that Barclays is dedicated to maintaining the highest ethical standards and is taking decisive steps to address any concerns arising from the Staley scandal. The CEO’s response reflects an understanding of the gravity of the situation and a determination to restore confidence in the bank’s governance.

The Impact on Barclays’ Reputation

The Epstein revelations and Staley fallout have undoubtedly impacted Barclays’ reputation, both in the financial world and the public eye. The bank, which has long been regarded as a pillar of the British banking industry, now faces the challenge of rebuilding trust with clients, investors, and regulators. The fallout from the scandal has led to increased media scrutiny and public scrutiny, with many questioning the bank’s oversight mechanisms.

Barclays’ reputation management strategy will be crucial in navigating this crisis. The bank must demonstrate its commitment to accountability and ethical conduct to mitigate the damage caused by the revelations. This involves not only addressing the immediate concerns but also implementing long-term changes to prevent future misconduct.

Regulatory Actions and Investigations

In the wake of the revelations, regulatory bodies in the UK and the US have launched investigations into the extent of Staley’s relationship with Epstein and whether there were any lapses in Barclays’ internal controls. These investigations are focused on determining whether Staley’s actions compromised the bank’s operations or violated any regulatory requirements.

The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) in the UK have been particularly vocal in their demand for answers. They are scrutinizing the bank’s due diligence processes and assessing whether Barclays adhered to its own policies in evaluating Staley’s conduct. Meanwhile, the US Securities and Exchange Commission (SEC) is conducting its own inquiries into the matter, adding further pressure on the bank.

Implications for the Financial Sector

The Epstein revelations and Staley fallout have broader implications for the financial sector, prompting a reevaluation of how banks manage relationships with high-profile clients. The scandal serves as a wake-up call for the industry, highlighting the importance of robust compliance frameworks and the need for enhanced oversight of senior executives.

Financial institutions are now under increased pressure to review their internal policies and ensure they are equipped to handle potential reputational risks. The scandal has also sparked discussions about the role of corporate governance in preventing misconduct and maintaining public trust in the financial system.

Stakeholder Reactions and Market Response

The reaction from Barclays’ stakeholders has been mixed, with some expressing concern over the potential long-term impact on the bank’s performance. Investors are particularly wary, as the scandal could influence Barclays’ market position and profitability. Analysts have noted that the bank’s share price has experienced fluctuations in response to the unfolding events, reflecting investor sentiment and uncertainty.

Clients, too, have voiced their opinions, with some questioning whether the bank can uphold its commitment to ethical standards. Barclays’ response to these concerns will be critical in determining its ability to retain clients and maintain its position in the market.

The Path Forward for Barclays

As Barclays navigates the aftermath of the Epstein revelations and Staley fallout, the bank must focus on rebuilding its reputation and reinforcing its commitment to ethical conduct. This involves not only addressing the immediate challenges posed by the scandal but also implementing structural changes to prevent future lapses in judgment.

Barclays’ leadership will need to demonstrate transparency and accountability in their actions, working closely with regulatory bodies to resolve any outstanding issues. The bank must also engage with its stakeholders, communicating its efforts to rectify the situation and outlining its vision for the future.

The road ahead for Barclays is fraught with challenges, but with decisive action and a commitment to integrity, the bank can emerge from this crisis stronger and more resilient.